distribution code 3 box 7 Get started: Watch and learn from our expanding video series. Most videos are . Wooden box springs are known for durability and sturdiness, while metal box springs are lighter and more budget-friendly. To find the best box spring , consider factors such as support, compatibility with your mattress type, ease of assembly, and noise levels.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Wooden Fence to Steel Post Adapters are designed for attaching round metal posts to your wooden fencing. By doing so, you are adding structural support .

No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.No, box 7 code 3 does not mean it is a non taxable distribution. If you take a .

Find TurboTax help articles, Community discussions with other TurboTax users, .Get started: Watch and learn from our expanding video series. Most videos are .Find answers to your questions about view all help with official help articles from .

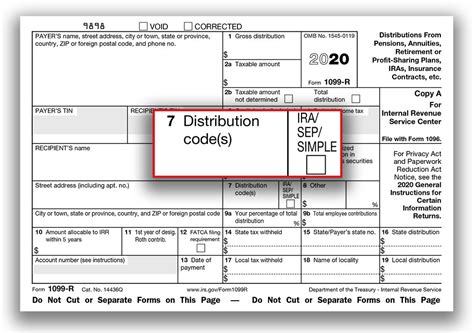

For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

Code 3. Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended. A Code 3 in Box 7 of a 1099-R means you are taking the distribution as a result of a disability. As KatrinaB states above, the Box 7 codes identify the type of distribution and .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

pension distribution codes

This chart clearly identifies the distribution codes for Box 7 of form1099-R, . (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions . No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

Code 3. Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended.

A Code 3 in Box 7 of a 1099-R means you are taking the distribution as a result of a disability. As KatrinaB states above, the Box 7 codes identify the type of distribution and whether the distribution is taxable and/or subject to a penalty.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. This chart clearly identifies the distribution codes for Box 7 of form1099-R, . (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. Code 3: Disability. None: Code 4: Death. 8 (Excess Contributions, Excess Deferrals, and Excess Aggregate Contributions taxable in year of distribution)

Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply. No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . Code 3. Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended.

A Code 3 in Box 7 of a 1099-R means you are taking the distribution as a result of a disability. As KatrinaB states above, the Box 7 codes identify the type of distribution and whether the distribution is taxable and/or subject to a penalty.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. This chart clearly identifies the distribution codes for Box 7 of form1099-R, . (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. Code 3: Disability. None: Code 4: Death. 8 (Excess Contributions, Excess Deferrals, and Excess Aggregate Contributions taxable in year of distribution)

irs roth distribution codes

Find many great new & used options and get the best deals for Antique Japanese Bronzed Box - Dragon - Metal Copper, wood lined. at the best online prices at eBay! Free shipping for many .

distribution code 3 box 7|box 7 code 4