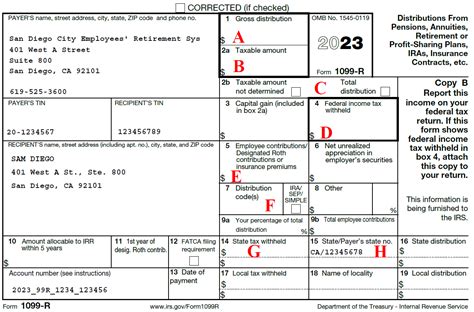

1099-r box 2b total distribution I have a large distribution (completer withdrawal) in box 1, nothing in box 2a and 2b and an amount larger than box 1 in box 5 and code 7D in box 7. The reality is that box 5 was . Metal roofs are a strong and long-lasting choice for your home. Read our guide to metal roofs and their related costs and labor before installing one.

0 · what is a 1099 r for tax purposes

1 · 1099 taxable amount not determined

2 · 1099 r profit sharing plan

3 · 1099 r gross distribution meaning

4 · 1099 r exemptions list

5 · 1099 r distribution from pension

6 · 1099 r boxes explained

7 · 1099 r 2a taxable amount

These industrial storage cabinets with drawers include a rugged, reinforced cabinet bottom. All of the metal storage drawers fully extend for 100% visibility. Each drawer also holds up to 400 lbs of parts and pieces. Our drawer glides open smoothly if a drawer is either empty or fully loaded.

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.File Form 1099-R for each person to whom you have made a designated distribution .For distributions from a Roth IRA, generally the payer isn’t required to compute the .For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

I have a large distribution (completer withdrawal) in box 1, nothing in box 2a and 2b and an amount larger than box 1 in box 5 and code 7D in box 7. The reality is that box 5 was . Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to .receiving a 1099-R? Although the distribution was not taxable, it is still considered a reportable event, so we have provided the 1099-R for your records. The taxable amount of the distribution .For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a .

Box 2 reports the taxable amount of the distribution as reported by the payer. Thus, the retirement plan or annuity has determined what the amount to include in income is. This amount should be reported on line 4b or 5b of the Form 1040. IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which .Do you have a "Taxable amount not determined" checked in box 2b despite a taxable amount being reported in box 2a? The IRS requires that your custodian report the full amount of your IRA distribution in box 1 (Gross distribution).

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. I have a large distribution (completer withdrawal) in box 1, nothing in box 2a and 2b and an amount larger than box 1 in box 5 and code 7D in box 7. The reality is that box 5 was an amount contributed to an annuity with after tax dollars.

Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to determine it. Total distribution - The entire balance of the account has been distributed. There’s a second box in Box 2b: Total Distribution. If you see a checkmark here, then it means that the distribution you received over the tax year effectively closed your account. Box 3: Capital Gainreceiving a 1099-R? Although the distribution was not taxable, it is still considered a reportable event, so we have provided the 1099-R for your records. The taxable amount of the distribution should be stated as For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions..00 in Box 2a. Distributions from your annuity are generally reportable on Form 1040, Form 1040-SR, or 1040-NR.Box 2 reports the taxable amount of the distribution as reported by the payer. Thus, the retirement plan or annuity has determined what the amount to include in income is. This amount should be reported on line 4b or 5b of the Form 1040.

what is a 1099 r for tax purposes

IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which may impact your taxable income. . Box 1: Gross distribution — This is the total amount of money you received from your . some cases, this may be the same as Box 1 .Do you have a "Taxable amount not determined" checked in box 2b despite a taxable amount being reported in box 2a? The IRS requires that your custodian report the full amount of your IRA distribution in box 1 (Gross distribution).If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

I have a large distribution (completer withdrawal) in box 1, nothing in box 2a and 2b and an amount larger than box 1 in box 5 and code 7D in box 7. The reality is that box 5 was an amount contributed to an annuity with after tax dollars.

Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to determine it. Total distribution - The entire balance of the account has been distributed.

There’s a second box in Box 2b: Total Distribution. If you see a checkmark here, then it means that the distribution you received over the tax year effectively closed your account. Box 3: Capital Gainreceiving a 1099-R? Although the distribution was not taxable, it is still considered a reportable event, so we have provided the 1099-R for your records. The taxable amount of the distribution should be stated as For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions..00 in Box 2a. Distributions from your annuity are generally reportable on Form 1040, Form 1040-SR, or 1040-NR.

Box 2 reports the taxable amount of the distribution as reported by the payer. Thus, the retirement plan or annuity has determined what the amount to include in income is. This amount should be reported on line 4b or 5b of the Form 1040. IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which may impact your taxable income. . Box 1: Gross distribution — This is the total amount of money you received from your . some cases, this may be the same as Box 1 .

cnc 4 x 8 machine

1099 taxable amount not determined

Includes 3/4 Drive Tools, Shallow 12 Point Sockets. All tools are professional quality, made of high-grade chrome vanadium steel.

1099-r box 2b total distribution|1099 r profit sharing plan