distribution code 2 in box 7 Beginning January 1, 2024, the automatic rollover amount has increased from $5,000 to $7,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early .

What Is The Electrical Box In A House Called? It’s commonly referred to as the service panel, junction box, or breaker box. This box serves as the main distribution point for electrical circuits in your home.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Two Trees TTC450 PRO CNC Machine. TwoTrees; Benchtop; Under $1000 $ 549 00 $699.00. Add to Cart. Best Seller Expert Pick New. Two Trees. Two Trees TTC450 PRO CNC Machine - 500W Motor Kit Bundle. TwoTrees; Benchtop; Under $1000 $ 654 99 $699.00. Est. In Stock: Dec 6th. Best Seller Expert Pick. Snapmaker. Snapmaker 2.0 A250T Modular All-in-One 3D .

pension distribution codes

baileigh sheet metal brakes

irs roth distribution codes

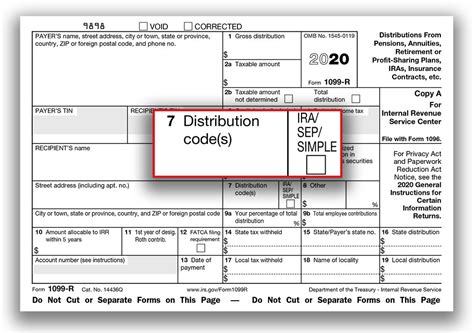

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, . 2. Early distribution, exception applies. Use Code 2 only if the participant has not .

Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not . Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t .Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

b468r carlon electrical wall box

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

2. Early distribution, exception applies. Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of . Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not being 59 1/2 regardless. A "7' wouldn't be any better than a "2". Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.2. Early distribution, exception applies. Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of .

Its not "normal" because you are not 59 1/2. Normal simply means 59 1/2. However, Box 2 means you are not paying the 10% penalty either way. So, you are not penalized for not being 59 1/2 regardless. A "7' wouldn't be any better than a "2".

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability.

It’s a SIM release tool to open/close your SIM tray.

distribution code 2 in box 7|irs roth distribution codes