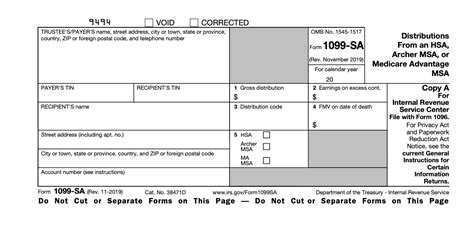

1099-sa box 3 distribution code 2 Information about Form 5498-SA, HSA, Archer MSA, or Medicare Advantage . P4W have been in business more than 10 years providing high-quality precision turned parts, from simple assemblies to complex, from relax to tight-tolerance turned components. Our experts manufacture any turning parts & screw machine parts needed to run your business.

0 · is 1099 sa taxable income

1 · is 1099 sa considered income

2 · 1099 sa where to find

3 · 1099 sa where to enter

4 · 1099 sa qualified medical expenses

5 · 1099 sa payer name

6 · 1099 sa gross distribution mean

7 · 1099 sa federal id number

We could guarantee you product or service good quality and aggressive value for Laser Cutting Metal Sheet, Fiber Laser Cutting Machine Manufacturers, Laser Cutting Stainless Steel, Best .

plants to hide your electrical meter box

is 1099 sa taxable income

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.File Form 1099-SA to report distributions made from a: Health savings account .Information about Form 5498-SA, HSA, Archer MSA, or Medicare Advantage .

is 1099 sa considered income

the gross distribution in box 1. If no earnings are distributed, enter zero in box 2. If earnings are distributed, enter the amount of earnings in box 2. Enter code 2 in box 3. See the instructions .

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical . You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the .

There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution . In 1099-SA, box 3 has code "2-Excess contributions" as the distribution code.

The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then . Box 3 of the 1099-SA form contains a distribution code that describes the nature of the distribution you received. The code provides information to both you and the IRS regarding the purpose of the distribution. . Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair .If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

the gross distribution in box 1. If no earnings are distributed, enter zero in box 2. If earnings are distributed, enter the amount of earnings in box 2. Enter code 2 in box 3. See the instructions for boxes 1 through 3, later. In addition, Form 5498-SA must be filed to report any rollover (qualified HSA funding distributions If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return.If the amount in box 2 includes earnings on excess contributions, You will have distribution code 2 in box 3. Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions.

There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes. In 1099-SA, box 3 has code "2-Excess contributions" as the distribution code. The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then TurboTax adds only the amount in box 2 to your Other Income (line 21 on Schedule 1). Box 3 of the 1099-SA form contains a distribution code that describes the nature of the distribution you received. The code provides information to both you and the IRS regarding the purpose of the distribution. Some common distribution codes for HSAs and MSAs include:

Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.the gross distribution in box 1. If no earnings are distributed, enter zero in box 2. If earnings are distributed, enter the amount of earnings in box 2. Enter code 2 in box 3. See the instructions for boxes 1 through 3, later. In addition, Form 5498-SA must be filed to report any rollover (qualified HSA funding distributions

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return.If the amount in box 2 includes earnings on excess contributions, You will have distribution code 2 in box 3. Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions. There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes.

In 1099-SA, box 3 has code "2-Excess contributions" as the distribution code. The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then TurboTax adds only the amount in box 2 to your Other Income (line 21 on Schedule 1).

1099 sa where to find

Box 3 of the 1099-SA form contains a distribution code that describes the nature of the distribution you received. The code provides information to both you and the IRS regarding the purpose of the distribution. Some common distribution codes for HSAs and MSAs include:

1099 sa where to enter

plasma cutting thin sheet metal

plastic electrical box knockout plugs

Industrial Metal Supply stocks a gorgeous line of wrought iron that includes hundreds of components. Professional fabricators and enthusiasts alike are able to select from various designs, shapes, supplies and materials – pieces that .

1099-sa box 3 distribution code 2|1099 sa gross distribution mean